APOLLO IQ-RIA

INTELLIGENCE QUANTIFIED

USING DISCIPLINED MATH TO ENHANCE FINANCIAL OUTCOMES

A Registered Investment Advisor Built specifically for the Retirement Plan Participant

DON'T LET WALLSTREET CRUSH YOUR RETIREMENT DREAMS

Apollo IQ Formula Based

Multi-Strategy Investment Models are Mathematically Designed for Growth

Our Mission

Delivering Education to Enlighten the Mind and Investment Options to Enhance Financial Futures

We give clients the intelligence, the tools, the resources, and the professional guidance necessary to build wealth by not losing it.

A mission that is focussed on disciplined math.

Our education modules unlock proactive strategies designed to help avoid unnecessary or devastating financial losses while providing the knowledge required to capitalize on opportunities that will maximize longterm financial outcomes.

Our Services

Quantitative Formula-Based Multi-Strategy

Model Portfolios

Targeted to outperform the S&P500 through multi year market cycles, our portfolios are an aggregation of some of the most historically consistant, time tested, sophisticated mathematical investment models from leading quantitative research firms. Our models prioritize "strategy diversification" over asset class diversification, with the intension of delivering consolidated stock & ETF portfolios, fully rules-based and reconstituted monthly.

Our Protect & Prosper Education Portal Platform helps retirement plan participants make educated financial decisions. We educate participants on little known, common sense strategies, to manage investments, manage debt, build income plans, manage taxes and address legacy issues.

Our professional Fiduciaries Advisors provide the enlightenment to avoid losses, reduce financial risks, capitalize on opportunity, protect families, protect assets, and improve financial outcomes. We deliver monthly education sessions in the workplace based on the 6 core areas of wealth management.

PROTECT & PROSPER FINANCIAL RISK MANAGEMENT EDUCATION PORTAL COVERING 6-CORE AREA OF WEALTH MANAGEMENT

Financial Risk Management Education Portal

Through our proprietary Financial Risk Management Education Platform, an aggregation of some of the most sophisticated and powerful financial strategies available, clients are professionally guided on identifying and mitigating potential losses in their financial lives. We provided the tools necessary to make educated decisions and personalized strategy to protect assets, reduce taxes, eliminate debt, avoid probate and never run out of money during retirement.

Quantitative Formula-Based

Multi-Strategy Model Portfolios

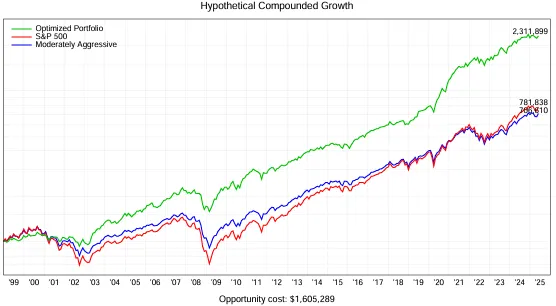

Opportunity loss can be one of the largest financial losses suffered by American investors. Apollo IQ uses some of the most sophisticated software and AI to analize and layer the most successful Quantitative formula-based models constructed into a proprietary AIQ Multi-Strategy managed portfolio. Our low cost, Stock/ETF Models, seek to outperform the S&P500 over multi year market cycles. Historically providing double digit alpha, less standard deviation and volitility, and lower drawdawn losses during market turbulance.

Litigation Avoidance for Businesses Operating a 401k

ERISA litigation is becoming increasingly more prevalent with over 300 lawsuits filed against business owners in 2020. Fiduciary liability makes the business owner in most cases personally liable for losses suffered by plan participants. Our experts help 401k & 403b sponsors mitigate the risk of litigation by addressing plan deficiencies and transferring the liability to professional fiduciaries.

Our Partners...

Apollo IQ, LLC is a Registered Investment Advisory firm register in the State of Florida. The firm conducts business only in States where properly registered or exempt from registration. Registration does not constitute an endorsement by regulators or the Commission. Registration is not an indication of a particular level of skill or education. Investment advisory services are only rendered after the delivery of the Adviser's disclosure statement (ADV 2A & 2B) by Apollo IQ, LLC and execution of an Investment Advisory Agreement between the client and Apollo IQ, LLC.

Compliance statement:

The information, data, and opinions contained herein this communication are provided solely for informational purposes only. To the extent permitted by law, Apollo IQ, LLC does not accept any liability arising from the use of this communication. You should not assume that any information, data, or opinions contained herein serves as the receipt of, or a substitute for, personalized investment advice from Apollo IQ, LLC or from any other investment professional. Past performance is not an indication of future results and actual results may vary. Investing carries an inherent element of risk, including the risk of losing invested principal

© 2025 Apollo IQ, LLC. All Rights Reserved